Jacob Petersheim

Well-known member

I had a Summer job once that paid $1.35, assembling scaffolds and painting State buildings. It seemed like good pay for a high school job.

DiscussionHQ is a general discussion forum that has opened December 2024!

We provide a laid back atmosphere and our members are down to earth. We have a ton of content and fresh stuff is constantly being added. We cover all sorts of topics, so there's bound to be something inside to pique your interest. We welcome anyone and everyone to register & become a member of our awesome community.

In the 2023 Budget, Finance Minister Nirmala Sitharaman declared a rise in the Tax Collection at Source (TCS) on foreign remittances, increasing it from 5% to 20% of the transaction amount.

Remittances to Mexico have declined substantially.India, like many other parts of the world, has always held gold as a store of wealth. If nothing else, as jewelry. Now they are making moves to invest "pension funds" (their Social Security, basically) into gold ETFs (exchange-traded funds).

I presume this is related to global market and currency concerns, perhaps seeking to diversify away from stocks and bonds.

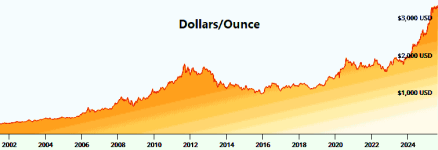

While this is "paper gold" with everything that implies, money pouring into gold ETFs could be expected to push up gold mining and refining stocks, gold futures price, and the daily on-the-spot price of gold itself.

Those of us on the outside of the gold game might be seeing bad news. U.S. Dollar value is rather close to inversely proportional to the price of gold. With other currencies either closely or indirectly tied to U.S. Dollars (as global reserve currency) there are implications all over the globe.

India is #2 in "remittances" drained from the U.S. economy, which is a large enough flow to be on the tax radar there:

I wouldn't be surprised to find that a share of that shores up their State Pension fund. They also have a proportionately larger base of works compared to retirees than the U.S. and most western nations.

So unlike us, they probably have a big bag of money in there to try to shield from inflation.

It all depends on how far you want to go. The "crazy preppers" here go so far as to install false septic tanks in which to store their goodies. Burying in the ground near your home is not the best choice. Preppers I know believe "seekers" will be using metal detectors if the economy collapses. Using a vacuum sealer for small valuables with a moisture absorbers (for metals) is a good choice for small items. They also tend to hide their stuff in trees, either on their property or in the wilderness with landmarks so they can find the stuff again. Their thinks is that seekers won't be waving the metal detectors in the air. The downside is that a ladder of some kind will be needed to retrieve their stuff. A good safe that can be hidden and bolted or lagged onto the structure of a building might be a fairly easy and reasonable choice.I was wondering where I would hide them if I owned 10 ounces of gold coins.

It seems like a thief after them specifically would pretty much know where people hide such things. They pull out and dump every drawer, look up under the emptied cabinets for something taped up in there, and maybe even take a crowbar to the drywall and tear walls and baseboards off. Of course any kind of safe would surely be hauled off first thing.

People talk a lot about burying things in the back yard. Maybe that isn't so nuts?

I thought about how I'd package the stuff. Gold is basically non-corrodible, but I think I'd put the coins into one of the plastic "tubes" they normally ship in. Then get a smaller thick-walled Mason jar with a stainless-steel silicone-gasketed cap. Put the coins inside, filling the jar up with unpopped popcorn, long recognized as a desiccant (who hasn't put a few into salt shakers?).

Then I'd get some of that waxed or urethaned "oilcloth" to wrap the jar, then stitch that up with braided/woven fishing line. Then maybe put that into a ziplock bag inside a second ziplock bag.

Even if the jar got busted over time I think the coins should stay safe.

Is that overkill? What ideas do you have? Maybe just some sort of stainless steel tin sealed up with Butyl rubber caulk? Thick plastic "ammo box" in two layers of ziplock bags?

I guess all metals including gold are, in a way, a fiat currency, since there value is determined by demand. There is a "value" placed on gold by international standards--I think it is $ USD at the moment, but that is far below what people are willing to pay for it. Some fear Trump will try to "revalue" gold to $10,000 to make our debt disappear, but I have no idea if that would be possible. FDR revalued gold, but FDR did many things the Democrats would decry as "tyranny" now.Anybody ever heard this one?

The Wizard of Oz is widely interpreted as a political allegory, particularly of the Populist movement and the debate over the gold standard in the late 19th century United States. The story's characters, settings, and plot points are seen as symbolic representations of figures and events from that era.Here's a breakdown of the key allegorical elements:Dorothy:Represents the "average American" or the naive citizen, caught up in the political and economic turmoil of the time.Dorothy's Silver Slippers:.In the book, these were silver, not ruby as in the movie, and are interpreted as representing the Populist call for the free coinage of silver, an inflationary monetary policy that would benefit farmers and those in debt.Yellow Brick Road:.Represents the gold standard, the prevailing monetary policy of the time, which many Populists believed was restricting the money supply and contributing to economic hardship.Emerald City:.Symbolizes Washington, D.C., the seat of political power, and potentially the illusion of prosperity under the gold standard.The Wizard:.Represents the US president, possibly William McKinley, who was seen as an ineffectual leader by some during this period.The Scarecrow:.Represents the naive farmer, lacking the "brain" (education and understanding) to navigate the complexities of the economic system.The Tin Woodman:.Represents the industrial worker, dehumanized by the industrial revolution and in need of "oil" (liquidity/money).The Cowardly Lion:.Represents William Jennings Bryan, a prominent Populist leader who famously delivered the "Cross of Gold" speech advocating for free silver.The Wicked Witch of the East:.Represents the Eastern financial interests, particularly those who benefited from the gold standard.The Wicked Witch of the West:.Represents the forces of nature, particularly droughts and other natural disasters, that impacted farmers and contributed to their economic woes.Toto:.Represents the Prohibitionist party, or possibly a loyal supporter of the Populist cause.The story's conclusion, where Dorothy realizes she had the power to return home (to the East, representing a return to the status quo) all along, further reinforces the idea that the Populists believed that they had the solutions to the country's problems within their own grasp.While Baum, the author, denied that the book was a political allegory, many scholars and historians believe that the story's underlying themes and symbolism clearly reflect the political and economic debates of the late 19th century.

It's interesting that in this interpretation silver is cast as fiat currency. Stackers and proponents don't appear to see it that way today at all.

I recall that as a kid I couldn't comprehend how "primitive" societies had been using "cockle shells" (probably a metaphor as often as literal) as "money."

It is become more obvious to me every day now that all forms of money are entirely artificial "markers" used to lubricate the process of trade. Gold is probably only special in that it is:

- Rare

- Hard to find and extract

- So resistant to corrosion and chemical combination that reusing it without waste is trivial

- "Pretty" and distinctive

- Alloyable for durability but refinable to recover purity

- Easy to confirm authenticity (the old "bite the coin" softness trope for example, the Archimedes weight/volume ratio)

- Has few other practical uses (jewelry, some electronics)

- Widely recognizable by all cultures now and in the past.

So did Nixon. Twice.FDR revalued gold

I bought a beautiful leather money belt (zipper on the inside) but it is just too small for one ounce gold coins. Fifty centers silver would fit and gold sovereigns.I guess I got too focused on weatherproofing once I considered the notion of burying the treasure. That's not really required for gold anyway. I suppose one might bury decoys (pennies, old bolts and nails) to discourage metal detectors.

But it seems to come down to 2 real factors: (1.) hiding it and (2.) making it hard to grab and run with. Obfuscation is normally considered a weak security strategy, so that does leave us something like a safe too heavy or too immobile to carry off.

FDR banned private gold ownership with Executive Order 6102 on April 5, 1933, requiring citizens to surrender their gold, coins, bullion, and certificates to the Federal Reserve. This order made it illegal to hoard gold within the U.S. and was later codified by the Gold Reserve Act of 1934, which transferred all gold ownership to the U.S. Treasury and was not lifted until the 1970s.