Jacob Petersheim

Well-known member

As you can tell this topic still fascinates me.

Checking the bigger online dealers I'm finding that some have stopped advertising 90% junk silver coins. Others still sell it, but in fewer package deals and at silver spot price or very close (aside from rare coins, near-uncirculated condition coins, and silver dollars).

Small local dealers are posting "Stop the Melt!" signs and selling t-shirts and such.

I suppose so many people needed money and saw silver spot rising and they dumped a ton of 90% onto dealers. Since it wasn't selling back out to others very well they've had to drop premiums. If they have to sell below spot it isn't worth the retail overhead, so off to the refiners a lot of it goes!

I'm sure the most worn-out slick coins go first, but sorting coins is too labor-intensive so a lot probably gets tossed into refiner buckets as is.

It's sad to hear so much history may be just melting away. I like the old Franklin and Kennedy halves and the Mercury dimes bring back memories.

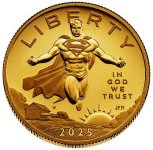

I'd also like a Peace Dollar in decent shape:

Of course that's a shiny commemorative issue. I'd want something from back in the original years of minting I think.

Checking the bigger online dealers I'm finding that some have stopped advertising 90% junk silver coins. Others still sell it, but in fewer package deals and at silver spot price or very close (aside from rare coins, near-uncirculated condition coins, and silver dollars).

Small local dealers are posting "Stop the Melt!" signs and selling t-shirts and such.

I suppose so many people needed money and saw silver spot rising and they dumped a ton of 90% onto dealers. Since it wasn't selling back out to others very well they've had to drop premiums. If they have to sell below spot it isn't worth the retail overhead, so off to the refiners a lot of it goes!

I'm sure the most worn-out slick coins go first, but sorting coins is too labor-intensive so a lot probably gets tossed into refiner buckets as is.

It's sad to hear so much history may be just melting away. I like the old Franklin and Kennedy halves and the Mercury dimes bring back memories.

I'd also like a Peace Dollar in decent shape:

The info above is a little dated, it seems a few more years saw commemorative mintings as well.The Peace Dollar was minted from 1921 to 1928, 1934, 1935, and as a commemorative coin in 2021. The coin’s design was selected as the winner of a competition to best portray a representation of peace. This design idea was to mark the years of peace that followed World War I. Although Congress never passed a bill to require a redesign, the Treasury Secretary, Andrew Mellon, approved the new design.

Anthony de Francisci created the new design that showed the Goddess of Liberty on the obverse, and a bald eagle grasping an olive branch with the word “Peace” underneath it.

Of course that's a shiny commemorative issue. I'd want something from back in the original years of minting I think.